🏡 Smart Mortgage Calculator

Table of Contents

What is a Mortgage Calculator?

A Mortgage Calculator is a tool used to estimate your monthly loan payments based on key variables like:

Home price

Down payment

Loan term

Interest rate

Currency

Loan amount

It also calculates total interest, total payment, and shows a payment schedule (amortization table).

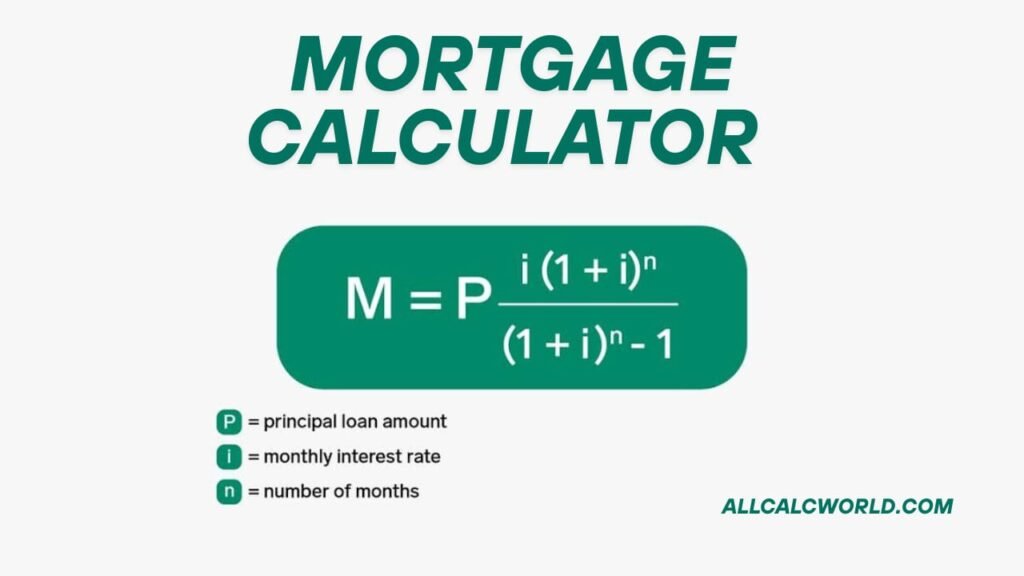

What is Formula for Monthly Mortgage Payment and terms used in Mortgage Calculator?

The standard formula used is derived from the amortization formula:

M = P [ i(1 + i)^n ] / [ (1 + i)^n –1

Where:M: Monthly mortgage paymentP: Loan principal (Home Price – Down Payment)r: Monthly interest rate (Annual Interest Rate / 12 / 100)n: Total number of monthly payments (Loan Term × 12)

📋 Terms Used in the Mortgage Calculator

1. Home Price

- The total cost of the property you want to purchase.

- Example: ₹50,00,000 (INR)

2. Down Payment

- The amount you pay upfront.

- It reduces the amount you borrow.

- Example: ₹5,00,000

- Loan Amount = Home Price − Down Payment = ₹45,00,000

3. Loan Amount

- The actual amount borrowed from the bank or lender.

- It’s what you repay over time with interest.

4. Interest Rate

- The annual percentage charged by the lender.

- Usually stated as APR (Annual Percentage Rate).

- Example: 7.5% per annum

5. Loan Term

- The time over which you will repay the loan.

- Usually in years (like 15, 20, or 30 years).

- Converted to months for calculation (

Loan Term × 12).

6. Monthly Payment

- The amount you must pay every month.

- It includes both interest and principal repayment.

7. Total Payment

- The total amount you will repay over the loan’s lifetime.

- Formula:

Monthly Payment × Total Months

8. Total Interest

- The total cost of borrowing the money.

- Formula:

Total Payment − Loan Amount

9. Amortization Schedule

- A month-by-month breakdown of each payment:

- How much goes to interest

- How much goes to principal

- What is the remaining balance

Example Calculation

Input:

- Home Price = ₹50,00,000

- Down Payment = ₹5,00,000

- Interest Rate = 7.5%

- Loan Term = 20 years

Step 1: Calculate Loan Amount P=₹50,00,000−₹5,00,000=₹45,00,000P = ₹50,00,000 − ₹5,00,000 = ₹45,00,000P=₹50,00,000−₹5,00,000=₹45,00,000

Step 2: Convert Annual Interest Rate to Monthly r=7.5100÷12=0.00625r = \frac{7.5}{100} \div 12 = 0.00625r=1007.5÷12=0.00625

Step 3: Calculate Total Number of Payments n=20×12=240n = 20 × 12 = 240n=20×12=240

Step 4: Plug into the Formula M=45,00,000×0.00625×(1+0.00625)240(1+0.00625)240−1M = 45,00,000 × \frac{0.00625 × (1 + 0.00625)^{240}}{(1 + 0.00625)^{240} – 1}M=45,00,000×(1+0.00625)240−10.00625×(1+0.00625)240

Using a calculator, M≈₹36,276.58M ≈ ₹36,276.58M≈₹36,276.58

📊 Graphical Breakdown

If total interest turns out to be ₹41,06,379, then:

- Principal: ₹45,00,000

- Interest: ₹41,06,379

- Total Payment = ₹86,06,379 over 20 years

This is visualized in:

- Pie Chart: % of principal vs interest

- Line Chart: Change in monthly interest/principal

- Bar Chart: Total loan components

if you interested in News, Current Affairs than visit us on: https://realtimekhabar.com

Our other useful calculators visit on : https://allcalcworld.com