G.S.T. Calculator

Table of Contents

Goods and Services Tax (GST) is a comprehensive, multi-stage, destination-based indirect tax that is levied on every value addition in India. Introduced on July 1, 2017, GST replaced multiple cascading taxes levied by the central and state governments such as VAT, service tax, excise duty, etc.

GST is classified into:

- CGST (Central GST)

- SGST (State GST)

- IGST (Integrated GST)

What is a GST Calculator?

A GST Calculator is a digital tool designed to help users compute the amount of GST payable or included in a transaction. It simplifies GST calculations by eliminating manual effort and minimizing errors. It is particularly useful for:

- Business owners

- Accountants

- Freelancers

- Online sellers

- End consumers

Purpose of a GST Calculator

- To compute GST amount on a product or service.

- To find out net amount (excluding GST) and gross amount (including GST).

- To determine input tax credits and tax liabilities.

- To help businesses quote the right prices inclusive or exclusive of GST.

How this Calculator Works

this calculator typically requires the following inputs:

- Amount: The base value of the good or service.

- GST Rate: The applicable GST rate (commonly 5%, 12%, 18%, or 28%).

- Tax Type:

- GST Exclusive: Tax is added to the base amount.

- GST Inclusive: Tax is included in the entered amount.

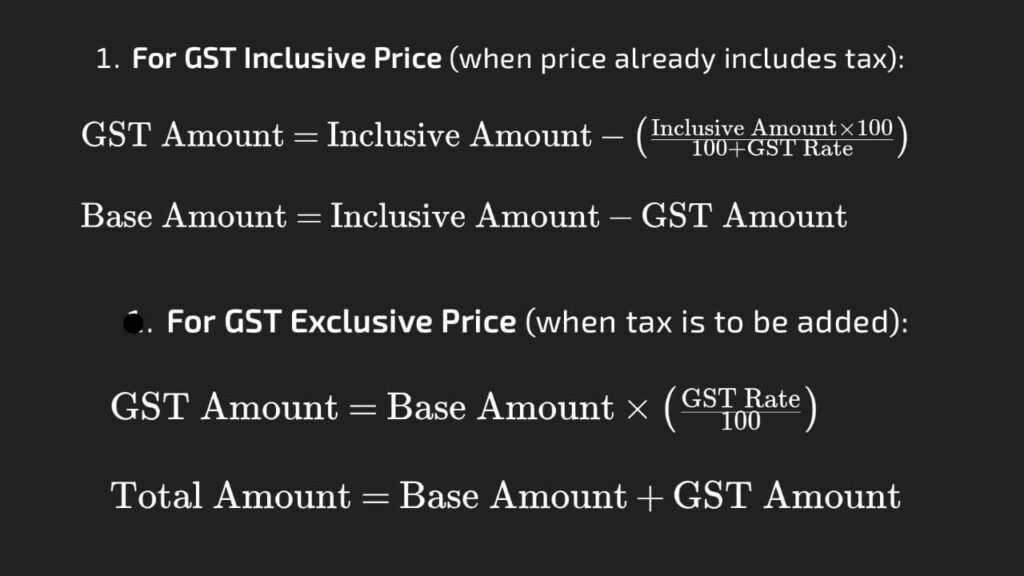

Formulas Used in GST Calculation

Example Calculations

Let’s say you have an amount of ₹1,000 and a GST rate of 18%:

- GST Exclusive:

- GST Amount = ₹1,000 × 18% = ₹180

- Total = ₹1,000 + ₹180 = ₹1,180

- GST Inclusive:

- GST Amount = ₹1,000 - (₹1,000 × 100 / 118) = ₹152.54

- Base = ₹847.46

Features of a Modern GST Calculator

- Input for amount and GST rate.

- Option to choose between inclusive or exclusive tax.

- Custom GST rate support.

- Display of:

- GST Amount

- Base (Net) Amount

- Gross (Total) Amount

- Responsive design for mobile and desktop users.

- Instant results without page reloads.

Benefits of Using a GST Calculator

| Benefit | Description |

|---|---|

| ✅ Accuracy | Eliminates manual errors in tax computation. |

| ⏱️ Time-saving | Instant results, especially for bulk invoices or transactions. |

| 💰 Financial Clarity | Clear understanding of tax liabilities and final prices. |

| 📈 Business Efficiency | Helps in setting the right prices and tax rates for invoices. |

| 🧮 Easy for Consumers | Understand how much GST they are paying on goods/services. |

Who Should Use a GST Calculator?

- Retailers & Wholesalers

- E-commerce sellers (like Amazon, Flipkart vendors)

- Service providers (consultants, freelancers)

- Students and educators

- Finance teams & bookkeepers

A GST Calculator is an indispensable tool in the Indian taxation ecosystem. It empowers users to compute taxes confidently, maintain accurate records, and ensure compliance with GST regulations. Whether you're a business or a consumer, using a GST calculator saves time, improves precision, and enhances financial understanding.