Compound Interest Calculator

Compound Interest Calculator

What is a Compound Interest Calculator?

A Compound Interest Calculator is a smart financial tool that helps you calculate the amount of money your investment or savings will grow into over time when interest is compounded.

Compound interest means you earn interest on both your initial principal and the accumulated interest from previous periods—resulting in faster growth compared to simple interest.

Whether you’re a student, investor, retiree, or financial planner, this calculator can help you:

💡 Forecast your investment returns

💡 Compare savings growth across different interest rates and timeframes

💡 Visualize your future wealth using charts

💡 Plan your financial goals accurately

-

How to Use Compound Interest Calculator?

Simply enter the following details:

Principal Amount (₹): The initial amount you are investing or saving.

Annual Interest Rate (%): The yearly interest rate your money will earn.

Time Period (Years): The number of years you plan to invest.

Compounding Frequency: Choose how often interest is compounded (Annually, Semi-Annually, Quarterly, Monthly, or Daily).

Monthly Contribution (Optional): Add recurring monthly savings to simulate SIPs or regular deposits.

💡 Once you click “Calculate”, the tool will show:

Total Amount you will have at the end of the investment period.

Total Interest Earned through compound interest.

Total Contributions made by you during the period.

A pie chart visually representing the breakdown of Principal, Contributions, and Interest. -

Benefits of Using a Compound Interest Calculator

Accurate Financial Planning: Understand how your money grows over time.

Visual Insights: Easy-to-understand charts help you analyze your financial progress.

Goal Setting: Set and track savings or investment targets.

Compare Options: Test different scenarios by adjusting rate, time, and frequency. -

Who Should Use This Compound Interest Tool?

This calculator is ideal for:

📚 Students learning the basics of finance

💼 Investors planning SIPs, fixed deposits, or mutual funds

👪 Families planning for children’s education or marriage

👴 Retirees projecting pension growth or savings

🏦 Bank customers estimating interest on recurring or fixed deposits -

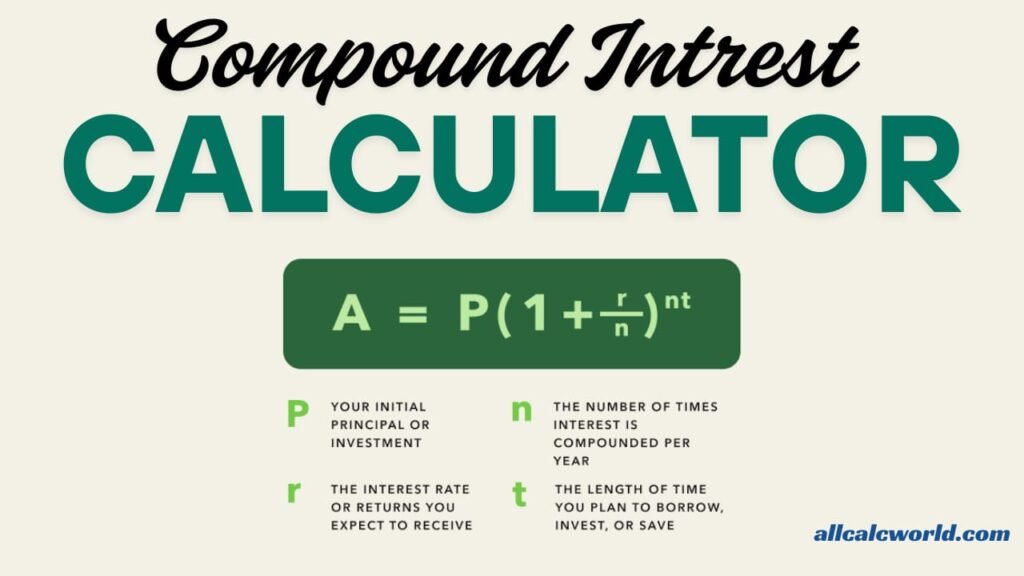

What is the formula for compound interest?

A: The compound interest formula is:

A = P(1 + r/n)<sup>nt</sup>,

where:

A is the final amount

P is the principal

r is the annual interest rate (decimal)

n is the number of times interest is compounded per year

t is the time in years -

How does compounding frequency affect returns?

The more frequently your interest is compounded, the more money you earn. Monthly compounding earns more than yearly compounding.

-

Can I use this calculator for SIP or monthly contributions?

Yes! Just enter your monthly contribution amount to simulate regular savings.

-

Is this calculator accurate for real-world scenarios?

While it’s a great planning tool, actual returns can vary due to taxes, market fluctuations, and financial product-specific terms.

Our other calculators available on our website : https://allcalcworld.com

- Mortgage Calculator

- Auto Loan Calculator

- Gold Price Calculator

- investment-growth-calculator

- Wedding Budget Calculator

If you have interest in Current Affairs than visit us on : https://realtimekhabar.com

Join Our WhatsApp Channel

Get instant updates, tips, and exclusive content directly on WhatsApp.

👉 Join Now